Acquisition project

Appreciate

Elevator Pitch: Appreciate provides effortless and affordable opportunities for Indians who want to diversifying their investment portfolio even beyond the borders. It solves the problem of complex and expensive investing by offering easy access to a diverse range of financial products such as US equities, mutual funds, and ETF's at minimal costs, with tools for micro-investing, goal-based planning, and automated savings.

What is Appreciate?

Want to invest in the U.S. in dollars? What if I told you that you could start with just ₹1? Confused? With Appreciate, you can make this a reality while keeping fees to a minimum. Excited? That's right—this platform offers you the chance to step into global investing effortlessly and affordably.

Founded | 2019 |

CEO | Subho Moulik |

Form Factor | Available on Android and Apple app stores. Features tools for micro-investing, goal-based planning, and automated savings. |

Region | Primarily catering to users in India, with a focus on expanding financial accessibility across the country. |

Value Proposition |

|

No. of Employees | 60-80 employees |

How about we start investing now ? 💹💰 Click Here

Let's take a look at Appreciate's Journey?

What Does Appreciate Wealth Solve For? ⚡️

Appreciate empowers Indian investors to seamlessly access global stock markets, breaking down barriers to investing in US securities. Other platforms often involve high fees and complex processes, leaving many potential investors feeling excluded. By offering low-cost investment options, easy remittance, and personalised goals recommendation and helping, Appreciate simplifies the investment journey, enabling users to grow their wealth while navigating the intricacies of international finance.

Before Appreciate:

Investing in global markets was often complex for Indian investors. Platforms charged high fees, lacked transparency, and offered limited access to diverse financial products. Many users struggled with fragmented tools, complex interfaces.

After Appreciate:

Appreciate revolutionises international investing by providing a platform that simplifies access to U.S. stocks, mutual funds, and ETFs. With micro-investing options and transparent pricing, users can diversify their portfolios effortlessly. The platform’s goal based planning tools helps investors to navigate their financial journeys with confidence and clarity.

Users & ICP's

Key Influencers:

- Young professionals who are just starting to invest and are willing to try out different platforms for their particulars needs and are conscious about transaction and forex charges.

- Middle aged or senior individuals who are managing multiple financial goals and would like to diversify their portfolio with ease and also able to have goals/planning for assistance.

- Tech savvy investors who make informed investment decisions and value platforms that offer advanced features like automated investment and goal tracking.

Key Blockers:

- Loyalty to established investment platforms such as Zerodha, Groww, and Indmoney due to their brand recognition and perceived reliability.

- Trust issues with a newer platform for handling investments, especially for those who have experienced scams or poor customer service.

- Resistance to switching platforms, especially for those who already have set up SIP's or other recurring investments on existing platforms.

- Perceived complexity of financial products, which can be a barrier for users who find investing complicated.

Customer Segmentation:

Description | Needs | Challenges | |

Frequency based investors | Regular investors who actively manage their portfolios, making contributions on a daily, weekly basis. They prioritise efficiency, automation and frictionless investment process. | Seamless investment setup Advanced data analysis and portfolio tracking Low transaction fees and other charges. | Balancing the frequency of investments with market volatility. Managing multiple investments without feeling overwhelmed by analytics |

Retirement focused investors | Individuals who retired or planning for retirement who prioritise capital preservation and stable income streams. | Tools for calculating retirement needs and simulating different investment scenarios. Low-risk investment options that provide consistent returns. | Managing risks associated with market fluctuations in retirement savings. |

Exploratory investors | New investors or those exploring different wealth management platforms, seeking to understand the investment landscape while evaluating their options. | Educational resources like articles that simplify investment concepts. User interfaces that lower barriers to entry and enhance user experience. Risk assessment tools to help them understand their risk tolerance and investment choices. | Overcoming anxiety associated with investing for the first time. Navigating a crowded market filled with complex offerings and potential scams. |

Product Feedback from users:

- Desire for quick withdrawals and deposits without excessive processing times.

- Need of more flexible payment options, including the integration cards, wallets and alternative payment methods. Currently they only support UPI.

- Wants significant improvements in customer support, particularly in response times for inquiries or issues related to KYC, Account opening and trades.

- Users have raised concerns about data security and would like more information on how their data is protected, as they lack 2-factor authentication now in few flows.

- Reported challenges during the onboarding process.

Products Data:

App Installs - 500K+, Average Rating: Google Play Store: 4.2 stars across 1.82K reviews

Ideal Customer Profiles:

Criteria | User 1 | User 2 |

|---|---|---|

Name | Romel Jose Varkey | Sebastian Joseph |

Age | 26 | 60 |

Demographics | Urban, single, nale, completed MBA, working in a fintech company, young professional, uses public and private transport. | Semi-retired professional, Tier-1 city, pension, 2-5 people in the household, uses private transport. |

Need | Requires advanced trading tools and insights or research information for investment decisions. Focusing on day trading as well long term investing and wants to diversify his portfolio. | Wants a reliable platform to preserve capital while generating a steady income stream. Seeks transparency and stability in investments. |

Pain Point | Frustrated with platforms that have high fees, lack of insights and easy to use but advanced trading features, highly complicated onboarding and other segments within the platform making the user journey really painful. | Frustrated by high transaction fees on platforms, inadequate analytical tools, complications in investing in global markets. Prefers investing in products like fixed deposits and dividend-paying stocks that provide regular income. |

Solution | Provide easy to engage platform with extension market data and insights helping in investment, advanced trading tools, competitive fees and creating a frictionless flow through the experience. | Low transaction fees, a stable portfolio of fixed-income products, and user-friendly tools for monitoring performance. |

Behaviour | Shows loyalty to brands that offers high performance but willing to change under situations, influenced by advanced features, frequent and high buying lifestyle, highly active on social media, early adapter of new technologies, interested in trying out different forms of lifestyles. | Prefers a set of trustworthy brands, influenced by ease of use and money, always prefers low risk, comfortable with technology but not advanced, prefers financial stability and balanced lifestyle. |

Perceived Value of Brand | Efficient, Frictionless, and tailored for traders and investors who demand top performance and requirements. | Trustworthy, reliable, and transparent with a focus on conservative investment strategies. |

Goals | Achieve significant financial returns through active trading strategies and also diversified investments. | Generate consistent returns while preserving the original capital. |

Frequency of use case | Daily with multiple log-ins for trading and monitoring market conditions. | Every week for investment and monitoring. |

Average Spend on the product | ₹1,00,000-₹2,00,000 per month on trading and investing. | ₹2,00,000-₹3,00,000 annually. |

Value Accessibility to product | Medium, Easy to use and frictionless and efficient and well equipped tools for trading and investments. | High, needs an app that's easy to navigate and offers simple financial products. |

Value Experience of the product | Fast execution, low fees, and in-depth market insights and advanced trading techniques. | Stability and appreciates the availability of steady, income-generating investments. |

Core Marketing Pitch

ICP #1: Young Urban Professional:

“Rich people acquire assets. The poor and middle class acquire liabilities that they think are assets.” - quoted in 'Rich Dad Poor Dad'. "Ready to take control of your finances by diversify your asset portfolio? With Appreciate, you can start investing globally by leveraging advanced cutting-edge tools and frictionless execution. Whether you’re day trading or building a diversified portfolio, our competitive fees and tailored insights and features make it easy to stay ahead in the fast-paced world of finance.

ICP #2: Middle-Senior aged Family Investor:

"Secure your family's financial future with Appreciate Wealth. Appreciate offers a range of stable, income-generating investments, from fixed deposits to goal based investments, all with low transaction fees and user-friendly navigation. Preserve your hard-earned capital while enjoying consistent returns without the stress of complicated processes. Simplify your investment journey and let us help you achieve steady growth, one step at a time.

Competitor Analysis

Company | INDmoney | Groww | Zerodha | Appreciate |

Account Opening and Maintenance Charges | Free account opening and no annual maintenance charges. | Free account opening and no annual maintenance charges. | Charges ₹300 annually for maintenance if you open a demat account. | Does not charge for account opening or maintenance. |

Brokerage and Transaction Costs | Zero commission on U.S. stock transactions, although currency conversion. | Charges a flat fee of ₹20 or 0.05% per order for equity delivery. | ₹20 per executed order for trading in Indian market, with additional fees for U.S. | Zero commission on U.S. stock transactions, although currency conversion. |

Forex Conversion Fees | Lower forex fees ranging from 1% to 1.5%. | Charge around 1.5% to 2% for currency conversion. | Charge around 1.5% to 2% for currency conversion. | lower forex fees ranging from 1% to 1.5%. |

Ease of Investing in U.S. Stocks | Allow direct investment in U.S. stocks, simplifying the process for users. | Offers U.S. stocks but requires a linked partner service, which adds a layer of complexity. | Requires a partner service for U.S. investments, making it less straightforward. | Allow direct investment in U.S. stocks, simplifying the process for users. |

Customer Support | Offers extensive support, including tools for financial planning. | Provides 24x7 support through calls and emails but lacks WhatsApp support. | Limited support window and emphasises self service tools. | Customer support quality is comparable. |

Platform Features and Tools | Personal finance tracking and goal-based investment features. Provides U.S. market research and insights. | Personal finance tracking and goal-based investment features. | Tools such as Kite, a powerful trading platform with advanced charting and market analysis. | Focuses on goal based investing, making it suitable for users who prefer planning for specific financial goals. |

Unique Offerings | Goal based planning and zero commission on US stock trades. | User friendly platform especially for beginners. | Best trading experience for Indian equities. | Goal based financial planning. |

Product Placement

Why Appreciate is Better:

- Micro-Investing: Start investing with just ₹1, making it accessible to all.

- Low Fees: Minimal charges compared to traditional investment platforms.

- Goal-Based Planning Tools: Empower users to manage their investment strategies effectively.

- Personalised recommendation: Highly curated investment insights, optimising portfolio growth.

What Appreciate Can Learn from its competitors:

- Enhanced App Experience: Providing better user experience in transaction processes.

- Customer Support: Improved customer support systems, including chatbots and other efficient helplines.

- Diverse Payment Options: Diversify payment options which they lack very much.

- Marketing Strategies: Better growth experiments and promotional initiatives as it's not well known yet among people.

Market Analysis

Total Addressable Market:

- The number of active retail investors in India is estimated at 85.3 million (Click here) as of 2023.

- Considering the Liberalised Remittance Scheme, Indians can invest up to $250,000 annually per person.

Serviceable Available Market:

- Assuming that 3% of active retail investors would potentially invest in U.S. stocks (Click here)

- Approximately 20-25% of potential investors leverage digital.

Serviceable Obtainable Market:

- Competing with platforms like INDmoney, Vested and Stockal.

- A new player like Appreciate could aim for a 3-7% market share.

Calculation:

- TAM = 85.3 million potential investors × $250,000 = $21,325,000 billion.

- SAM = $21 ,325 ,000 billion * 0.03 * 0.02 = $ 12,795 billion.

- SOM = $12 795 billion * 0.03 = $ 38,385 billion.

Transitioning from PMF to Early Scaling

After successfully establishing a strong Product-Market Fit over the past year and a half, Appreciate is now entering the early scaling stage. To accelerate this growth, I believe the following three channels will be the most effective:

- Organic Marketing: Leveraging content driven strategies and engaging social media presence will help build brand awareness and attract new users without significant marketing expenditures.

- Partnership Programs: Forming strategic alliances with complementary businesses and platforms will expand our reach, enhance our value proposition, and provide access to new customer segments.

- Enhanced Referral Programs: Optimizing our existing referral program will encourage our satisfied users to advocate for Appreciate, fostering a community of brand ambassadors that can drive organic growth.

By focusing on these channels, Appreciate can scale efficiently and effectively in its current market position.

Content Loops

For Appreciate, leveraging content loops particularly through Educational and Success Stories will be a powerful strategy for gaining traction and user acquisition.

Educational Content Loop

- Content Creation: Produce educational materials, including articles, videos, and webinars focused on investment strategies, financial literacy, and market trends.

- Distribution Channels and User Engagement: Distribute this content through social media platforms and learning channels, encouraging users to share their experiences, insights, and questions in community forums or on social media.

- Feedback and Iteration: Actively collect user feedback to continuously refine and enhance content topics and formats.

Success Stories Loop

- Content Creation: Share detailed success stories of users who have achieved their financial goals using Appreciate, highlighting specific strategies and insights.

- User Testimonials: Feature user testimonials in various formats like videos, quotes, articles to build trust and inspire new users.

- Regular Updates: Keep the community updated on new success stories and milestones achieved by users, encouraging a culture of achievement and motivation.

- Content loop flow

Product Integration:

Experiment 1:

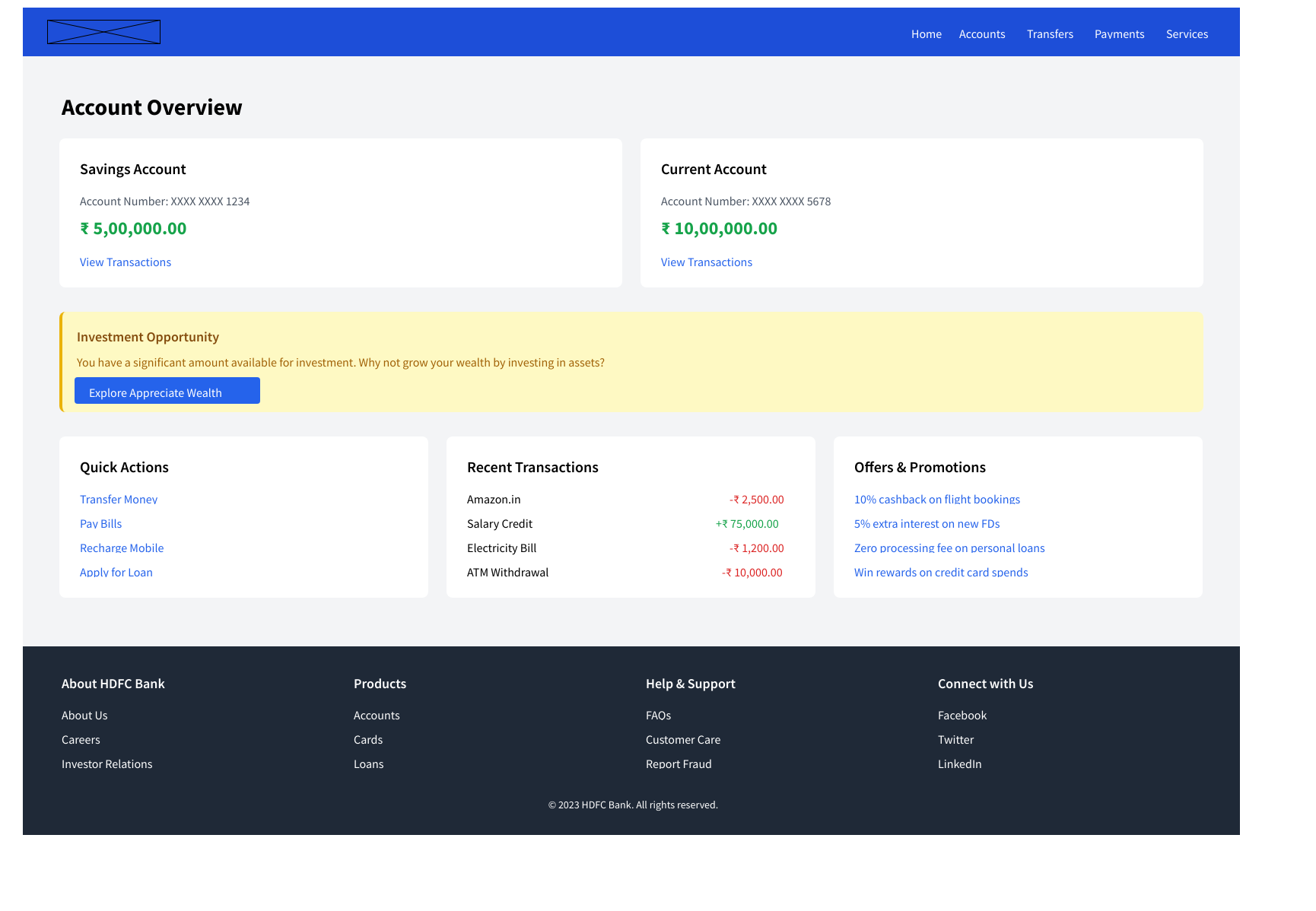

Appreciate, having integrated with YES Bank for account creation, presents a unique opportunity to deepen this partnership. By expanding the integration to nudge users towards investment opportunities, both Appreciate and YES Bank can benefit significantly.

Partnership Goals

- Enhance User Engagement: Increase user interaction within the platforms through personalized investment suggestions.

- Boost Customer Retention: Create a seamless user experience that encourages users to stay within the ecosystem of both platforms.

- Educate Users on Investment: Empower customers with knowledge about various investment opportunities beyond traditional saving or current accounts.

Benefits to Both Parties

- For Appreciate:

- Expanded User Base: By partnering with YES Bank, Appreciate gains access to a broader audience, allowing for potential user acquisition and engagement.

- Increased Product Adoption: Integrating investment functionalities encourages users to explore and adopt Appreciate’s offerings, leading to higher conversion rates.

- For YES Bank:

- Increased Customer Loyalty: Offering a comprehensive suite of services including savings, banking, and investments strengthens customer loyalty and reduces churn.

Experiment 2:

Through its integration with Darwinbox or other payroll applications, can leverage this partnership to offer enhanced services that promote employee investment and financial literacy.

Partnership Goals

- Enhance Employee Engagement: Create a platform where employees can seamlessly manage their payroll and investment activities in one place.

- Promote Financial Wellness: Encourage employees to invest in their future by providing easy access to investment options and financial education.

Benefits to Both Parties

- For Appreciate:

- Increased User Adoption: By integrating with widely used payroll systems like Darwinbox, Appreciate can tap into a larger user base, facilitating easier access to its financial products.

- Enhanced Brand Visibility: Partnering with a reputable payroll provider enhances Appreciate's credibility and visibility within the HR and finance sectors.

- For Darwinbox:

- Value-Added Services: Integrating Appreciate allows Darwinbox to offer comprehensive financial solutions to their clients, differentiating their platform from competitors.

- Improved Employee Satisfaction: Providing employees with tools for financial wellness can lead to higher job satisfaction, improved morale, and increased productivity.

Referral Program

Appreciate recently launched a referral program, but it is currently in its initial stages and has substantial room for improvement. By thoroughly examining all touchpoints in the existing referral flow and identifying areas for enhancement, we can implement several key changes to optimize the system. These improvements will significantly streamline the referral process and drive increased user acquisition.

The existing flow:

Availing referral flow:

Referring flow:

Referring flow:

New Referral Flow:

Availing referral flow:

- Giving more insights on the home page regarding the referral

- Removing the tradition 'code' based referring to 'token' based which brings a much frictionless experience for the users

- Nudging users with WhatsApp/instagram or any other social media tools in making the refer helping ease the flow.

Referring flow:

Referring flow:

- Exponential reward based referral system

- Giving in-depth insights about the referrals already made

- Offering referrals in much better 'happy flows' for the users which will increase engagement and further acquisition and retention.

Conclusion

As Appreciate continues to forge its path in the fintech landscape competition alongside big players in the market, its journey is filled with both exciting opportunities:

Future Prospects

- Financial Product Diversification: Offering more options of financial products & markets for customers will help unlock new customer segments and drive growth.

- Strategic Partnerships: Collaborating with other fintechs and financial institutions will amplify our reach and strengthen our value proposition.

- Data Utilisation: Harnessing AI and analytics will enable us to provide better personalize offerings, improve decision-making, and optimise user experiences.

Challenges Ahead

- Regulatory Compliance: Navigating the complex regulatory landscape will be essential, especially as we expand into new markets and products.

- Intensifying Competition: The fintech market is rapidly evolving, and staying ahead of emerging competitors will require continuous innovation.

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore foundations by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Crack a new job or a promotion with the ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.